trading cfd

Trading cfd

Traditional investing usually involves following a simple strategy: “buy low, sell high.” CFD trading follows that same pattern, but investors can also use an alternative method to try and profit from market moves: “sell high, buy low Versus Trade.”

Like other CFD brokers, the margin interest and leverage afforded differ based on the financial instrument and the market. But IBKR traders can rest assured that they’re getting competitive rates, regardless of their trading style. IBKR’s standard margin rates are some of the best in the field.

eToro is known for its social trading platform, eToro allows users to follow and copy the trades of successful investors. It offers a simple interface, a wide range of markets, and a demo account for practice.

Cfd trading meaning

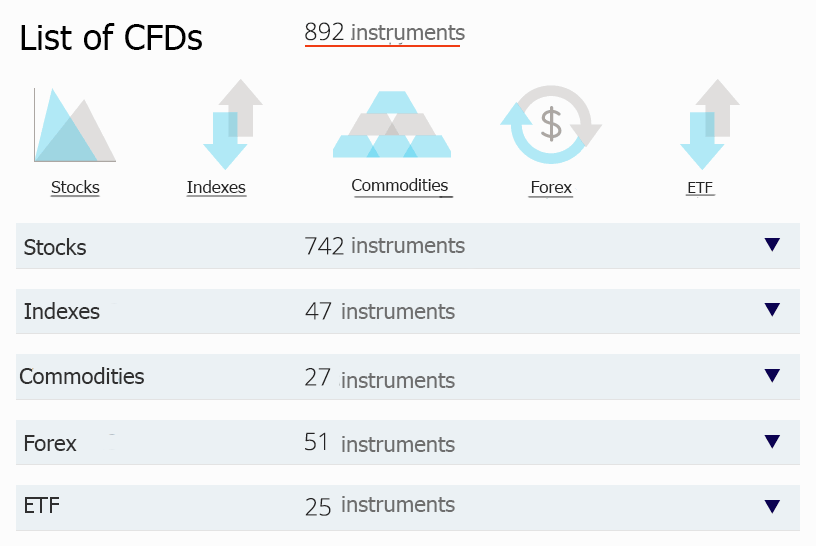

CFDs cover a wide range of markets, including stocks, indices, commodities, currencies, and cryptocurrencies. This provides traders with opportunities for diversification within a single trading account.

The most important point to remember when trading CFDs is that the broker that a trader chooses will have a great impact on the quality of his experience. CFDs themselves can’t be either good or bad, the provider is the one that needs to be chosen with great care to ensure we can reap the maximum benefits out of contracts for difference.

CFD trading is a form of derivative trading that involves buying or selling a contract for difference (CFD) on an underlying asset, such as a stock, currency, commodity, or index. CFDs allow traders to speculate on the price movements of these assets without actually owning them. Instead, traders enter into a contract with a broker to exchange the difference in the price of the asset between the time the contract is opened and closed. The profit or loss made on a CFD trade is based on the difference in price, multiplied by the number of contracts traded.

CFDs don’t have an expiry date so they can be held indefinitely, regardless of whether you have opened a long or short position. However, there are spreads and overnight fees attached to CFD trades, so holding a CFD for long periods can incur significant additional costs.

Based on your research of the market and ABC’s fundamentals, you think the company’s price is going to rise, so you open a long position by buying 10,000 CFDs, or ‘units’, at 100p each. A commission charge of £10 is applied when you open the trade as the commission rate for UK-listed companies is 0.1% (with a minimum fee of £9):

Cfd trading app

The best beginner’s platform for CFD trading is also eToro. If you’re new to CFD trading, the eToro Academy provides a common sense introduction to the strategy. CopyTrader gives you the chance to see how successful traders trade CFDs.

To start using a CFD trading app, you’ll need to download it through the app store of your choice. Once you’ve created a CFD trading account, you can explore the markets available and open long or short positions. Plus, you can set up trading alerts to receive in-app push notifications for instant updates on your trades and instruments. CFD trading app notifications allow you to monitor open positions on the platform and close them directly on the application.

CFD trading apps allow you to trade your chosen instruments with a mobile device wherever and whenever you want. Whether you’re investing from the UK, US or Australia, CFD trading apps offer global access to markets from one mobile trading platform. Your account usually accessed on your desktop should mirror the positions on your mobile app, making for seamless trading wherever you go.

While CFDs make it easy to speculate and have the potential to generate very large ROIs, this example shows how much fees cut into profits and exacerbate losses and why so few traders make money trading these instruments.

To start trading CFDs, you will need to use platform software provided by a broker. This can be accessed via desktop, web platform or mobile app. However, CFD trading using an application allows you to execute trades through a mobile device, such as a tablet or smartphone. CFD mobile trading has revolutionised traditional methods of investing, offering greater control on the go instead of being bound to your desktop.

With certain types of spot forex trading, traders can take delivery of the asset (currency). For example, a trader that buys the EUR/USD with the ability to take delivery of the asset will pay for the transaction in U.S. dollars – and will, in turn, receive euros in their account. By contrast, a CFD trader that buys the EUR/USD cannot take delivery of any currency, and can only close the position by selling an equivalent amount of EUR/USD to exit the trade.

Hinterlasse einen Kommentar

An der Diskussion beteiligen?Hinterlasse uns deinen Kommentar!